Business Planning | Risk Analysis

Following on the series of business planning related blog posts including:

What a good business plan looks like?

Developing a Business Planning Process

Professional Service Leverage Models

Leverage in a consultancy business

Vision, Mission and Objectives

Building a Service Proposition Framework

Market and Competitor Analysis

… this post looks at another key business plan element: Risk Analysis.

We are nearly there now. This has been a long series of blog posts but, hopefully, you have now got a sense of the basics your business plan should cover. In final analysis, however, being a successful entrepreneur is about managing risk. This section, therefore, is about you stepping back from all the preceding analysis (market, competitor, financial etc) and asking yourself where the key risks (and opportunities!) lie.

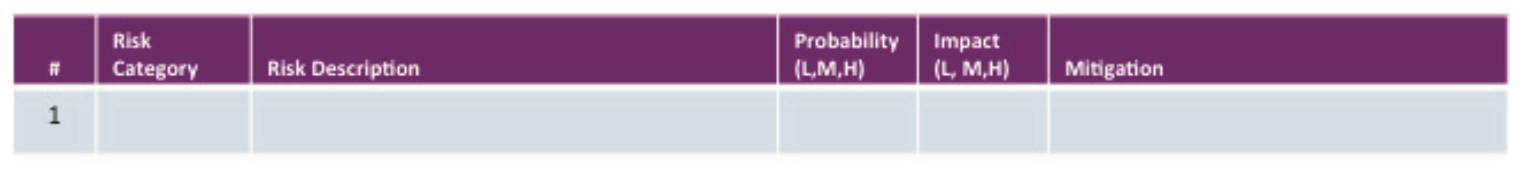

The activity of managing risk in your business is an existential, permanent one but the function of penning (and updating) your plan is an ideal opportunity to review the landscape. A risk management discipline is the ongoing iteration of an ‘identify–assess–plan–implement–monitor’ process. So, this section of your plan addresses the first three (risk analysis) activities and the output of this thinking is best represented as a risk log, or register.

By now, you should have little problem identifying risk types … they come from everywhere. It is useful to apply some categorisation to them; for example: financial, people, reputation, operational, economic etc. An actual risk is then an articulation of a potential occurrence that could jeopardise the success of your business. The assessment is about judging each risk’s main characteristics – specifically, the probability of it manifesting and the impact on your plans if it does. Finally, this leads you into response planning; the effective ‘so what?’ you draw from this exercise. Response planning comes in many variants. You can seek to prevent risks (e.g. changing your course of action to avoid completely), reduce them (e.g. actions to lower probability and/or impact), transfer them (e.g. an insurance policy), contingency plan (in response to the risk coming about), or simply ignore them.

The value of this part of your plan is not about the words you set down on paper (albeit this is a useful reference point) but the quality thinking you should have applied to arrive at this point. Keep all of this proportionate, however. It is easy to become paralysed as a result of risk analysis and, in worst case, you see some people acquainting risk management with long list administration. Keep it simple; say, the capture of your top ten strategic risks with considered mitigating actions resulting.

That’s it for my series on business planning.

Next in line will be a similar series on another critical aspect of successful professional service firms: business development.

————

If you are interested in re-charging your business ambition/strategy/plans, Dom runs an annual (three-day) Five-Year Entrepreneur Retreat – see here for previous delegate testimonials and details on future presentations. If you would like to make a reservation (capped to 14 attendees per Retreat) please drop a line via the contact page.

DOWNLOAD GUIDE 03 (BUSINESS PLANNING) HERE >>>