The ‘Multiple’ component of a firm’s valuation

So, having in previous articles, covered the importance of profit as a core component of value, let’s turn now to the ‘Multiple’ component of the typical valuation formula.

As I mentioned in an earlier piece, once profitability is under control this should be the key aspect of value on which you turn your managerial focus. Of course, the vagaries of the macro economy, and/or the specific idiosyncratic circumstances of any buyer, do have an influence here … but nowhere near to the extent you have. A sound company, led by an owner who understands this fundamental point, will always achieve multiples at the top end of the trading range, even in a bear market.

The main point being – the most important of this set of articles – that you can, through deliberate decision, investment and activity, take full control of this value lever. What is more, you can do so through a systematic approach that my guide series lays out for you.

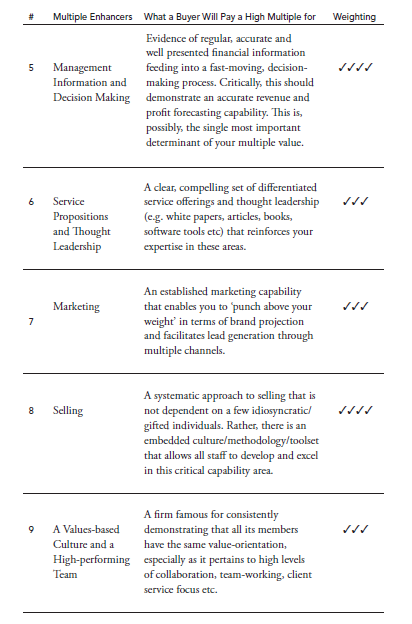

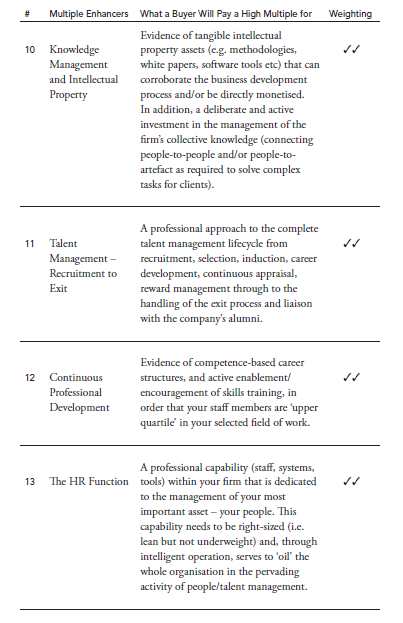

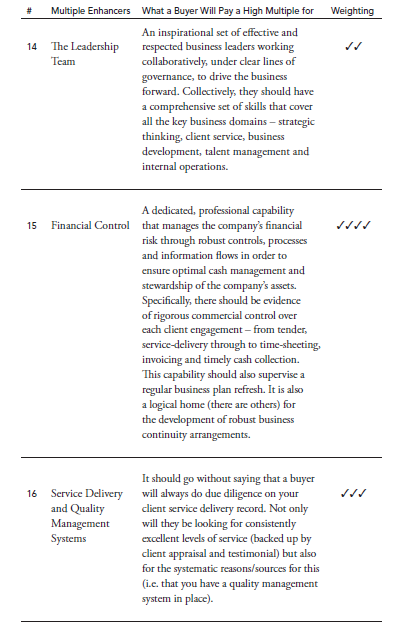

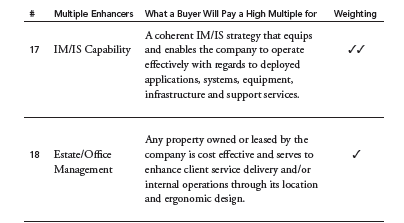

Let me start then by giving you an overview of the elements that you will need to deliberately build capability in if you are to grow this multiple figure. I call them ‘Multiple Enhancers’ and – you will not be surprised to note – I have structured my thoughts/guides along these lines.

Each of the guides in the ‘Building’ part of my series is mapped to a multiple-enhancer element. Each corresponding multiple-enhancer guide lays out the critical value determinants for that element and give you pragmatic advice, tips and tools required to enhance that aspect of capability. In turn, this is all contributing to your firm’s overall ability to produce predictable, quality profit streams … hence you are building towards that overall top-of-the-range multiple figure for your company.

By way of a quick summary here, the table below gives you an indication of the capability targets the series will help you progress towards (as seen through the eyes of a potential future acquirer):

In the next article, I will explain how I organised the Moorhouse team around the ‘multiple enhancer’ idea in the early stages of the firm’s growth.

——————