How to value a professional service business?

I cover this question in detail in Guide 02 (as well as plenty of advice as to how best to grow it!) but this post covers some basics.

There are a number of valuation methods used to value companies generally – ranging from asset valuation, liquidation or book value, the modelling of future income streams through to industry-specific ‘rules of thumb’.

When it comes to professional services businesses, however, one viewpoint comes to the fore. Simply put …

Valuation is driven by the expectation of future profit.

That is, a buyer is primarily interested in the total amount of ‘Owner Benefit’ they can extract in the future based on a business’ historical trading performance and its current organisational capabilities. As such, the most common valuation method is a variant of:

Profit x Multiple

Typically, the value used for profit in this equation is:

EBITDA x Multiple

Where EBITDA stands for ‘Earnings before Interest, Tax, Depreciation and Amortisation’. In reality, there is often little by the way of asset depreciation and amortisation in a typical professional services firm, so you will also see common reference to the simpler EBIT (‘Earnings before Interest and Tax’) variant.

Analysts will also look at ‘top line’ revenue multiples, but this is done typically as a crude proxy when they suspect that the reported earnings figures are not an accurate representation of the actual levels of ‘discretionary cash flow’. For example, the owner of a business may take some of the discretionary cash flow out in the form of a bonus – above the profit line – and hence artificially

depress a reported EBITDA figure. This, in turn – from the perspective of an external analyst reviewing a company’s purchase price – could lead to a very high EBITDA multiple. What they are not privy to is the adjustments often made to reported EBITDA figures, in the course of such negotiations, in order to bring them back in line with normal treatment. As such, aware of this blind spot, analysts often examine the revenue multiple of a reported sale price also – as this ‘top line’ figure is clearly less susceptible to such tinkering.

In relation to your business, however, a typical sale value discussion will involve the buyer getting access to a true, or normalised, EBITDA figure (for the last twelve months) and then a critical negotiation around the firm’s EBITDA multiple will ensue.

Lets pause there because this is important.

One simple way of looking at this, is that the multiple is the number of years a buyer would have to own the firm in the future, trading at its current level of profit performance, before their purchase outlay is paid back. A buyer is, however, not expecting static growth and, indeed, you are very unlikely to be engaged in such a negotiation if your company is not on a clear profit growth trajectory. Rather, the multiple, therefore, is an indication of the quality of the company’s trading capability. Understanding how this quality attribution is made up in the mind of the average buyer is absolutely critical.

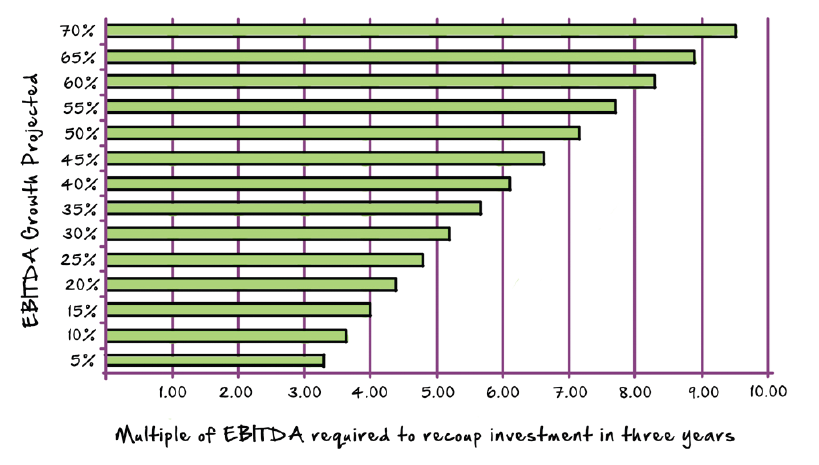

Another way of coming at this, from the perspective of a buyer financier, is as follows. A typical buyer will seek to recoup their outlay in, say, three to five years. Let me assume, prudently, that you will end up negotiating with a bullish buyer who seeks to recoup the investment in three years. Based on your historical EBITDA growth figures (and perhaps their ability to make even greater gains through cross-efficiencies) they will project the EBITDA that will be produced, post acquisition, over this period. And, this figure is what they are willing to pay now. Dividing this by your current EBITDA is, therefore, the effective multiple they are willing to pay based on this payback horizon. By example, from the chart below, if your EBITDA is growing at 30% per annum, such a buyer would countenance paying a five-times multiple.

Figure – Illustrative EBITDA multiples a financier would be willing to pay based on a three-year payback period (against a range of projected annual EBITDA growth rates)

This is a pure financial analysis, based on an arbitrary (but typical) payback period; notwithstanding, you should be aware that an analysis of this type will certainly have a key place in the negotiating buyer’s mind.

There is another axiomatic point to be drawn from this. In that your objective is to maximise this compound value, but your management time is finite, on what side of the ‘EBITDA x Multiple’ equation should you focus (or is it just a case of even distribution)?

Well, of course, growing EBITDA is a priority. You will not even get to be in the game if you can’t demonstrate this management record. But, and it is a big ‘but’, within parameters. As soon as you are achieving healthy levels of year-on-year profit growth (say 20% or greater), you are very likely to be better off deliberately skewing your time and effort towards the ‘Multiple’ (or quality) aspect as far greater gains to overall value can be made here.

To illustrate, consider a business that is making $1m of EBITDA and advancing well at, say, 20% EBITDA growth per annum. In terms of its business infrastructure, and qualitative assessment, lets just say a buyer would value it as a 5 x EBITDA company. Next year, therefore, if growth continues on track, the company could be worth $6m ($1.2m x 5). If the owner really ‘bust a gut’ on the

profit growth side (achieving 30% EBITDA growth), maybe they could get this to $6.5m ($1.3m x 5). Suppose, however, that growth rates were held and managerial effort focused more on improving the qualitative aspects of the firm – thus moving the buyer’s multiple offer to 7 x EBITDA or an $8.4m business? You get the point?

Clearly this is a simplification but it is a really useful one to make at the heart of everything you do. Once healthy profit growth is established, you will need to focus on developing the elements of the business that make this sustainable; that improve your qualitative value in the eyes of a potential buyer. You will only be able to grow revenue and profit so fast (indeed, you may damage your business by growing too quickly) but you can make significant strides in the more elastic aspect of your company’s multiple value with focused attention to this aspect.

Understanding this point, and having an awareness of the components that make up this qualitative multiple, is – therefore – critical to your future business success; certainly, an essential prerequisite to any deliberate ‘build to value’ journey.

—

When the service company is a broker (in this case, print), is trying to sell the client list, would you suggest a rollover period where the seller is ‘on call’ to the buyer? Thus helping to cement the relationships with clients? Do you have any thoughts or advice I can access on this topic? Thank you.

Paula

In the sale of a service company, it is very typical for the buyer to request that the owner(s) stay on for a period of time for just this very reason i.e. to ensure an orderly hand-over of client relationships etc. Indeed, it is common for the buyer to structure the deal such that you only take a percentage of the sale at the actual time of transaction and the remainder is then ‘earned out’ as you traverse this period (and often against key targets – ongoing EBITDA growth etc). Whether you seek this as the seller is another question altogether; you might just want to ‘sail off into the sunset’ to enjoy your hard earned spoils. As such, this point is just one of the many aspects of negotiation in a trade sale exercise. It is, however, unusual for the owner to be able to depart immediately as – unless you have really prepared the ground for this (reducing the business’ dependency on you to sell/deliver work well in advance) – it is normally wholly impractical to do so from a business continuity perspective.

Earn out periods vary by sector and, to a degree, each deal can be very different in this regard. On average, I would say a one-to-two year earn-out period is common in the consulting services sector (my experience was even longer – three years). Again, remember it is just one aspect of a whole package so you might tolerate a slightly longer ‘earn out’ if other aspects are more favourable (e.g. overall price, completion sum, earn-out targets, management autonomy etc).

Hope this helps in advance of me completing the full guide on this topic!

I am looking at buying a window cleaning business that grosses $84,000 per year and 30,000 goes to an employee and about 5000 per year in expenses. So the owner works and brings in about 49,000 a year. There is no guarantee for client base However this business has been in operation for four years and has improved each year I was trying to determine how much this business would be worth The owner is willing to take $25000 down and then take 20% of the gross sales for one year. I don’t know if this is a good price or not it will end up after the 20% if it stays at 84,000 the price would be roughly 40 to 50,000 for the business Does this seem like a good way to establish the value of this business

Cynthia.

Window cleaning businesses are not really my forte but let me share some perspectives nonetheless – in the hope they are helpful to you. There are a couple of really key questions here. The first one is to what degree the client base will retain its loyalty to the company (cf. the previous owner). Clearly, there are no guarantees but you would need to get a really good sense for this. In worst case, could the former owner set up in competition and win all the business back under a new operation. I don’t suppose for one moment this is the intent but you would wish for any commercial legals to make this an explicit assumption/restriction. Conversely, if there is a good chance that you retain 90%+ of the business (and maintain a “word of mouth” growth trajectory) then it is a very interesting opportunity. No reason why this shouldn’t be the case as window cleaning is one of those services that if done well, and within an established pattern, why would you switch?

Next, it hinges on the new company (newco) staffing model. Is this going to be you replacing the previous owner or hiring someone else? Regardless, you need to factor in what is the sensible/normal salary for such a replacement. Let’s say it is $30k (per the other employee) and you maintain the client base: then you will be making c. $20k profit each year. If so, then the valuation of $25k + 20% gross sales appears fair. Another way of then looking at it – is that you should have paid this transaction back after two years of similar profit.

As I say it all really hinges on the value of the client base (and the degree to which you can retain) – there is little else of value in such a business.

Finally, of course, you need to model the cash flow (to ensure all affordable). Also, make sure the retained employee is motivated/loyal to continue (he/she will be key during the transitory period). Last, but not least, if this is you switching in – that it is a job you will enjoy!

Wishing you every success regardless of where the decision ultimately falls.

I meant to say the owner is willing to take $25,000 down not $250,000

Hi,

I am an immigrant with 27 years experience in teaching and managing schools. I am planning to buy a existing/running tutoring centre in Scarborough(Toronto) area. The monthly profit is around 2000 dollars, but it decreases during school holidays and summer. Kindly let me know how to evaluate the value of this business.

Anwar.

Thanks for the question. A tutoring centre will be more of a business-to-consumer (B2C) service I would guess (or maybe a mix of clients – businesses and individuals). As such, a little off the topic of my Guides. That said, the basics will still apply re: valuation. If you are sure the stated profit figure is sound (i.e. reflects the true nature of costs, salaries etc) then this is the starting point. Let’s say for argument sake it is $20,000 per annum pre tax and any (loan) interest. Next you might want to see if you can find any trading figures for similar companies that have sold … to ascertain what the range of typical profit multiples other buyers have paid. One way of looking at this … if you felt the profit was going to be static … would be how many years you are prepared to work on the business to pay back the original outlay? For example, if you have a mindset of paying back in two years, then you would pay $40,000. The more interesting/desirable scenario is, clearly, one where you believe you can build on this profit … in which case you would be prepared to pay a higher multiple. You would countenance a higher multiple for businesses with greater predictability/security of future profit (e.g. long-running contracts for provision of future students, great reputation/brand in your market, differentiated teaching materials/content, opportunities to use your skills/networks to grow into new markets etc).

Ultimately, however, this is just a negotiation. The valuation will ultimately be what a buyer is prepared to pay. Your strategy needs, therefore, to give as much thought to the competitive landscape and the seller’s circumstances. If you are the sole bidder and they are very keen to sale … you can, clearly, make a much lower bid than if just one bidder in a competitive exercise.

So … pithy answer to a multi-dimension topic … hopefully gives a bit of a steer. Good luck!

I am a home inspector and I have been working as a contractor for another home inspection firm for about 5 years. The owners of that firm are interested in selling me that company and leaving the business over the next 5 years. This is a very low overhead business with little in the way of inventory or equipment. There is no physical premises involved; we all office out of our homes. The value of the business is basically the book of business (referral relationships) and name recognition in the market. I have built a book of business of my own, but their business is still considerably larger than mine, and they have good name recognition and are respected in the market. Their gross sales were about $200k last year and mine were about $50K. About 75-80% of gross winds up as earning before taxes. They want $200k for the business with 10% down and the remainder financed. I have no idea if that is fair, etc. Any thoughts you wish to share would be much appreciated.

Rick

At first flush, it seems reasonable … but ‘devil always somewhat in the detail’. Questions I would ask …

(1) How far forward does there order book go … can it be relied on to provide quality referral work for first year say? Is there any way you can link this ‘promise’ to the amount you pay post deal … i.e. the previous owners effectively earn-out this value based on the ‘promise’ of this order book?

(2) What is your true earnings before tax % (i.e. after you have removed your fair, market-level salary costs)? … if true profit after doing so is, say, $40k then this would seem fair (i.e. a 5* multiple business)

(3) From a buyer’s perspective, think also in terms of how long to pay back. You will want to do the math with the different key variables … (a) starting at a level of your combined revenues (say $250k from Year 1), (b) EBIT% figure – say 20%, (c) growth ambition – say 20% year-on-year. If so, then you will have enough free cash to pay the debt back completely in c. three years. Typically, you wouldn’t want it to take any longer than this for such a business.

The pay back mechanic of 10% up front, the rest as debt repayment seems very reasonable. Many deals typically ask for much more up front.

If you haven’t already done so … my Guide 02 could be useful to you as it explores a number of these themes.

I wish you all the best with the conversation.

My colleague and I are interested in becoming partners and growing Santa Fe Supportive Therapy (which has just been me as a psychotherapist till now) into an organization that employs other therapists. I have developed a fair bit of name recognition in Santa Fe and a good referral network – my caseload is currently full and I’ve had to refer new clients to other therapists for a few months. There doesn’t seem to be any way to value my Santa Fe Supportive Therapy business name given that our plans include a much larger picture and earnings potential than what I’ve been able to do alone. Plus, my colleague also has a name for herself, but hasn’t put as much energy into advertising herself. How do we value my business name in terms of what she would pay to become a partner?

Anika

Many apologies for delayed revert. I have been extremely busy in recent months … not least preparing for and delivering the inaugural 5YE retreat. In answer to your question … this is not a straightforward question.

One approach might be to argue for a (theoretical) value of your business based on the evidential earning potential it has today. This, for example, would be your current profits plus the additional profit you would make were you able to service the additional leads that you are currently referring on.

Another approach I would suggest though (at least for consideration) is some form of option scheme whereby your colleague earns increasing share option in your business over time. Such schemes can be made contingent on their promised support/BD actually materialising (for example, 5% share in your business each year that they meet BD targets up to an agreed maximum/cap) thereby massively reducing your risk of giving too much away up front. Share options are still valued at the point of gifting but the (cash flow) advantage for your colleague is that they do not have too ‘pay’ for them until the point of actual exercise (when effectively they receive the uplift in this grant valuation and the actual sale value). In this regard, I would suggest they are only exercisable at the point of a future company sale (and, indeed, are relinquished if your colleague were to leave before this date – unless you grant otherwise as a ‘good leaver’). The value of the share options as they are granted in tranches might be something simple/modest like 2-3 * EBITDA for historical 12 months (in the UK it needs to be a sensible level you can justify to HM Revenue).

Finally, I would say that if you are talking about 50:50 partnership please tread very, very carefully. I have seen these work but such successful couples are in a small minority. In my experience, far better to have a clearly delineated business lead and some form of option scheme that other trusted seniors can build up equity in. See my Business Organisation guide for more on this if of relevance.

Its an involved area Anika and I am not as familiar with US regulations on shares/options as I am with UK practice so please take advice from your company accountant in this regard.

I wish you – and your colleague – every success.

This is good advice. I would also add that as a professional Business Broker recasting or adjusted the financials is very important indeed when valuing a small business for the purposes of sale as many owners use the business to pay for discretionary expenses like Autos, travel, etc. If you are seeking to get a quick idea what your business might be worth for initial research purposes visit: http://www.fastbusinessvaluations.com

Hi Dom, I have begun some discussion with my boss about buying a valet and transportation firm that he built and has owned for about 7 years. The gross sales are about 240K and the EBITDA looks to be about 100K. There is no real estate, but there is about 65K in vehicles and about 50K in debt on those vehicles. The numbers we are talking is 140K with 40K down and 20K a year for 5 years. The main client is in the process of cementing their need for our service and there is a good reputation that I have built as a manager for the past year. What are your thoughts?

Jeff

Firstly, just to say sorry for such a delayed revert … a combination of being extremely busy with the companies I advise … and this site receiving a lot of spam comments (that hide the genuine users). My thoughts … if still relevant … on the surface this looks like a very reasonable/fair deal. You are right to take a balance sheet view of things (i.e. car asset cf. debt liability) as well as the multiple * EBITDA view. The primary aspect though is the predictable/ongoing profit-earning potential … so scrutinising the deal through the lens of ‘how much work is near guaranteed’ is critical also. If the nature of the business is low risk in this regard (e.g. service contracts) you are in a very good place. Be careful about one dominant main client though … you are far better off having a wider portfolio to de-risk that ‘black swan’ event that sees them parting company with you. Companies with extremely dominant single clients are virtually worthless for this reason/risk. The repayment terms seem very fair also. All things being equal … if you can deliver the same trading performance then you can, effectively, finance the whole deal and the car asset in two years (this assumes all reasonable costs factored in to overhead – your salary etc). And, with your reputation you should be able to grow the business to even greater reward.

If this ship has already sailed, I wish you every success with it!

I am a 75% owner in a IT staffing firm. We have no fixed assets. We basically place people and say pay them $X, while the customer pays us $X + Y. Y is our profit. We have no real expenses other than some payroll, car payments, telecom etc.

We have secured contracts with some large Fortune 50/500 companies that allow us to fulfill their requisitions directly. Company was started in 2010, EBITA was 30k, in 2011 $130k, In 2012, the EBITA was 900k, in 2013, it was 700k and in 2014 550k. In 2015 we project 400k. The sales have dropped because we partners have lost our focus and due to some other personal issues. I want to sell my 75% share to either my partner or someone else.. how would I value my share? Profit Margin is 23%.

Anni … this is a difficult one. On one hand, there are real positives … evident growth potential, framework contracts and healthy profit margin. On the other (less positive) hand, there is the recent loss of focus/sales. On the surface (and an inherent challenge of recruitment-based businesses generally) this would appear to be business with a high reliance on 1-2 key sales staff (i.e. you and your partner). As such, value in the firm can literally ‘walk out the door’ with you. The nub of this value assessment is to what degree the sales pipeline is reliant on you cf. your firm’s brand, reputation, guaranteed contract flow etc. The best determination of this value might be one that you and your partner are best placed to make i.e. it is whatever value you settle on as being mutually fair!

Hi Anil,

I may want to buy your business. There is still a chance?

Best

Adri

What is the up and down side of buying a small single operator professional service firm( 18 year old business services with approximately 30- 40 clients) and what is the best way to structure the sale and buyout?

Kristina. From the perspective of a buyer, this is typically a very high risk transaction – as the value is likely to be completely tied up with the sole operator. The more integral they are to business development, client relationships and the delivery of ongoing services – the greater this risk. One of the real challenges is that such a business – prima facie – will appear to have hit a real ‘ceiling’ i.e. there is limited potential for revenue/profit growth. If this is not the case, the buyer’s next logical challenge will be – well why has it remained as a solo operation for 18y? None of this is absolute; as per always, the analysis can only really be made when the full facts are understood re: nature of services, nature of client relationships/contracts, systemised/codified IP (cf. idiosyncratic, tacit knowledge) whether there is possibility for easy transfer of relationships and delivery provider etc.

If these risks were all accepted by the buyer – and the original owner was integral to future growth/value – then the sale would typically be structured with a large component of the agreed purchase price being subject to a earn-out clause i.e. the owner would only receive this residual settlement contingent on actual future revenue growth, transfer of relationships etc.

How would you value a medical transcription company? YE EBITDA at $115,000. Using EBITDA x 3 seems logical. What about adding in discretionary income into EBITDA too?

Michael. Thanks for your question. I am no expert in your specific service sector so it is difficult to comment on the multiple (3x) in relation to other comparable deals. That said, regardless of market averages for your specific service type, the multiple will be a function of multiple qualitative buyer valuations. Not least: historical trading record, predictability of forward revenues, number of clients, contract status, service uniqueness, your company’s brand/reputation, reliance on key staff, intellectual property etc etc. On the surface, in relation to the broader category of professional services, 3x would be quite low but a final determination on this matter can only be made once the characteristics of the actual business are taken into account. Discretionary income would typically be discounted if it is not part of the systematic, future fee-earning potential of the business (e.g. reliant on a key individual who is not part of the deal post sale or truly ad-hoc, non-core revenue).

i have been approached by my Client who is giving me business to acquire my company. we are a privately held company with myself and my wife as owners. we are providing services for this company. since it is privately held majority of the personal expenses are treated as Business and the Profits are shown less.I would like your suggestions on providing a quote for the same

Prakash

My first comment would be say – I always advise my clients to be very wary of single, unsolicited offers. They rarely provide full value for businesses (indeed, evidence suggests they end up discounting to c. 80% of value you would achieve in a structured/competitive sale) and such conversations often lead to nothing whilst being hugely distractive to your main focus of company growth.

That all said – to the substance of your question – you should just seek to present the financials as ‘normalised’ i.e. remove the anomalous charges from the P&L in order to restore the profit line to what it would realistically be under new ownership. This can then be your starting line for negotiations.

I would also say that valuation will then be wholly dependent on other factors – do you have a wide client portfolio (cf. primarily this one client), is there IP/tools/methodology backing up your service (cf. just the expertise of you and your wife) etc? The more it is at the latter end of this spectrum (i.e. effectively you are just becoming employees for new owner) the less value in your company (and this more a hiring conversation).

Good luck.

Thank you for an excellent post. It is one of the most clearly written on the topic that I have come across.

My questions are in regard to a classic technology consulting company (basically a systems integration firm/digital agency), about 100 people, $10M revenue, 15% EBITDA. We are negotiating the valuation to use in a shareholder’s agreement for a significant but minority (15% ownership) new owner. The goal is to grow the company to $25M to $40M and then sell the company. (3-5 year project.)

I have two follow up questions. First, can you give any examples of the “qualitative” types of attributes that managers should pay attention to in order to increase the multiple that might be applied in a future acquisition. Second, is the value of debt + payables – cash – receivables typically factored into the valuation?

Thanks so much!

Michael

Thanks for your kind comment.

In terms of your follow-up questions:

(1) My guide 02 (Fundamental Components of Value) deals with that question but by way of headlines, such examples would be the clarity/uniqueness of your market proposition, the quality of your client portfolio/relationships, your ability to accurately forecast forward revenue (really important), your intellectual property, your marketing and selling capability (systematic cf. reliant on 1-2 individuals), quality of your team (professional development programmes etc.) etc.

(2) Yes, deals will always factor in the balance sheet in this regard – essentially to adjust your valuation by this net asset/liability position as a final deal calculation.

As an aside, when you are bringing in minority ownership to help with growth, take good accounting/legal advice. Key instruments to consider are share options and growth shares; both can be drafted pretty flexibly to reward the recipient contingent on their contribution to the forward growth (whilst recognising they have not perhaps contributed to the firm’s growth/value to date).

Good luck with the project!

Thanks, Dom. That is just what I was looking for and I will definitely take a close look at your guide. I’m so glad I found you and your site.

Thanks Michael; very kind of you to feedback. I wish you every entrepreneurial success – enjoy the guides.

Thank you very much for the well-written article. You are providing a lot of very useful insight.

Please know it is appreciated!

Hi Dom,

we are looking to sell our furniture rental service. Given the inventory we have, should be be using a multible of EBT or a multiple of EBITDA valuation model?

Thank you,

Alex

Hi Alex

I would have to say, firstly, that this sector is not my area of expertise (my focus is professional services). That said, I would suspect that your sector may well focus more on the EBITDA variant – as management of interest and asset depreciation are likely to be dominant features of such a asset-centric business. I would encourage you to speak to experts in your sector. Good luck!

Dom, I own a consulting firm and my employee is considering purchasing the business. The company is formed as an LLC. When calculating the EBIT, how do I figure the tax portion since it all flows through to my personal tax return? Would you just select a 30% tax and use that figure? Thanks!

Hi Annette

As a UK resident, I am not an expert on US tax albeit I understand that a US LLC is treated as a “pass-through entity” where all LLC profits pass through to the LLC members (and their personal income tax returns).

The principle you want to try and model is the removal of any business/corporation tax not the reversal out of personal taxation (as this will, by its nature, vary with individual/idiosyncratic circumstances). One possible way to “normalise” such a calculation might be to model the company as a corporation (separate legal entity) with your market costs factored in (i.e. ask what costs would the company bear – guaranteed income plus employer costs – to hire someone of your equivalence) and work it out from there.

Put another way, the key is to get to a fair evaluation of what is the pre-tax monies that flows to you (as a function of your labour) cf. what is the money that flows to you (as a function of the effective “dividend” you are making on company profits). The first is a gross cost that needs to be removed (reflecting the need that the business will probably need to effect a like-for-like replacement); the latter, you can argue that the tax component can be reversed out for the basis of this valuation.

Seek expertise from LLC accountants would be my final point; they will be used to such valuation adjustments I am sure. Good luck.

I have a computer consulting business and we do about 150K per year in billing. However, all of our profit has gone into paying salaries and office expenses. A potential purchaser that would take a hands-on approach to the work would greatly reduce expenses. What is the best way to value such a company. Is there a guide I can purchase that can assist me in this endeavor? I am new to this site.

Hi Joe. Unfortunately, you will have quite a struggle in persuading a purchaser to value your business on theoretical, future profit (cf. actual profits, historical growth, evidenced future contracts etc). It sounds like this negotiation will really come down to “what the buyer is prepared to pay and you are prepared to sale for”. You might be best to take a “more hands on approach” and “greatly reduce expenses” yourself first – before selling your business? I would also recommend trying to doing this within a competitive, multiple-party exercise cf. in response to a single approach. It has been shown that such (single party) negotiations, on average, end up discounting c. 30% off the value you would derive from a competitive exercise. The best guide on this matter is: https://dommoorhouse.com/guide/the-fundamental-components-of-value/

Thanks for the quick response and suggestions. I will check out the guide you suggested. We are not looking to make a killing here. The owners are preparing to retire and want to leave our clients in good shape, most of which have been with us for many years. We were hoping that turning over a guaranteed income from our 40 active clients would have a little value, though.

Once again, I appreciate your sound advice.

A pleasure Joe; I wish you all the best with this.

I just ran across your article and am in the process of leaving a company I own with a partner. I offered to sell to my partner who is saying there is no value in the business and I should just walk away after splitting whatever is in the bank 50/50. We are in the service industry for interpreters. We operate B2B. We have contracts but nothing is for certain with this type of business and can change year to year. Is my partner right in thinking there is no value? Or am I missing something? We have operated for 3 years and made a profit 2 of those years with the last year being 70,000 that we split between us. There are contracts for this upcoming year in place, and a huge potential for profit, but that potential has not been tapped into as of yet. I’m confused as to why this type of business would “not be worth anything”. Please correct me if I’m wrong, but I feel like it could be valued based on potential profit (as stated in the article above) as well as upcoming contracts.

Hi Heidi. Thanks for your question. Splitting just “what is in the bank” is arbitrary; it will be a function of timing and cash-flow as much as anything else – so you are right to question that approach. If the company has been profitable (after fair salaries drawn?) then this really needs to be factored in; especially so if trading profit over the three years is on an improving/growth trajectory? If the performance is a little more erratic/unpredictable then – commensurately – value is much more disputable. It sounds like you do have some significant assets with regards client contacts and contracts in the pipeline. That all said, your partner can clearly argue that your departure impacts business development, delivery of service etc – so there is a negotiation to be had here. Ultimately, this type of situation comes down to a sensible discussion between two people. If you have doubts that you are being undersold (with reference to likely future profit stream) then you can always hold onto your shareholding (I assume – linked to the rights of your shares on departure) and benefit from these distributions. Good luck.

Hello. I own/operate an in home appliance repair business with my father, est 1978. We are considering buying another smaller appliance repair business that runs basically parallel to ours. It has been in business for 30+ years and has a decent customer base. We basically would just buy the phone #s. But we have no real idea what a phone # would be worth. Is there a percentage of the business income that those phone #’s should be valued at? The owner has passed away, and his wife wants to retire. So there is no threat of owner opening a new business to compete. Thanks for the help.

Hi Daniel. As a business-to-consumer business this is not my sector of expertise. All I would say is that you are essentially buying the ability to access a customer base (known clients of this service) assuming that is what this list of numbers is? In that case (if there are no other immediate competitors?) the value of each number could be viewed – very simply – as follows:

1. Calculate average value of each of their clients (total annual revenue/clients); say, for example, $100,000/1000 = $100 per client

2. Estimate likely conversion to your services (clearly will depend on overall competitive landscape); say, for example, 50%

By simple example, this would lead to an annual estimate value per contact of $50 per contact.

Such logic might take you to the following negotiating tactic: offer $50,000 (conversion % x total revenue). You will essentially then have bought one-years business. Assuming yours is a great service and you easily win client retention/loyalty, then the upside is all revenues/contribution/profit post year one.

So, as always, many variables you need to carefully consider – not least competition, your ability to convert and your confidence in retaining. I would also add that phone numbers only one part of contact information – hopefully you would get full details (address, email etc) – as nowadays, phones are an increasingly difficult way of accessing customers (business and consumer). Fundamentally, you want to buy contact with their client base – along with their messaged “good will” to this client base i.e. them effectively saying: “we trust the new owners to continue providing you an excellent service”. To this end, you might also seek to de-risk the investment by making it contingent on actual % conversion.

Hopefully some useful ideas at least.

Good luck!

I have a small nationwide service business. We service large manufacturers laboratory equipment. We have an excellent reputation throughout the industry. I have been told by a vendor that we are the only independent nationwide service group they could find. I was told a major part of our value is the value it can add to a buyers organization, as setting up a service group to handle a single product line is expensive. I have not seem any of your evaluation comment on good will. Is there any guideline to evaluate this?

Carl

In my Guide 02 (The Fundamental Components of Value), I look at such ‘Additional Value Considerations’. You are referring to ‘buyer synergy’ which – as you infer – can be a very potent part of any valuation. Difficult to put any valuation guidelines on it – as completely case-by-case – suffice to say, that it can be incredibly valuable if your capability is the “missing part of the jigsaw” for the vendor. See some relevant text from the Guide below:

We have looked now at all the elements of a company’s value that you, as a directing owner, have real influence over. In summary, you increase your firm’s value by growing profit and by embedding the ‘multiple enhancing’ capabilities (which make such profit growth sustainable).There are, however, other factors that will in influence any valuation – market premium and buyer synergy.

By market premium, I am referring to the general state of the market. In a bullish phase of the economy, companies will trade with a premium on average multiples (sellers’ market). Conversely, in a recessionary period, with less merger and acquisition activity, multiples will be depressed against a historical average. The key point here is to do with the timing of your value realisation point. You should, clearly, take a perspective on the likely economic cycle you are in before you set any ‘value realisation’ time schedule.

By buyer synergy, I am referring to the situation of a trade sale when a buyer is attracted to a particular aspect of your company (services, geographic reach, client base, resource skill set) which, when added to their model, unleashes an exciting, new profit-yielding capability. Think ‘1 + 1 = 3’ logic. The more idiosyncratic/rare this matching is, the higher a synergy premium you can command. If the combination really works for the buyer, if it really talks to a strategic growth ambition they have, then the synergy value can be so high as to dwarf all the other sources of premium value I have mentioned.

At first flush, it may appear that you have minimum control over these latter two aspects but this is not so. Getting the right market premium is about having a dynamic, strategic timetable and constantly monitoring the macro/economic conditions to select your future, ‘sweet spot’ moment. Similarly, you can improve the chances of a premium buyer-synergy sale by undertaking a thorough buyer search-and-tell exercise at the start of any competitive sale process.

HOW DO YOU VALUE A BUSINESS SUCH AS A GYM OR FITENSS CLUB?

Hi Joseph. This is far from my area of expertise – so you should seek an industry expert in your sector. That said, I would fully anticipate that similar to professional service firm valuations, there is a real focus on EBITDA (earnings before interest, taxes, depreciation, and amortisation) i.e. it will be a multiple of EBITDA contingent on “quality” and size of your business. Clearly, there will be a real focus on your membership and the evidenced history of their revenue contribution – as supports your future fee pipeline and growth projections. You should obsess over such data – membership growth, average member fees/spend per month, membership retention/attrition rates, average member tenure etc. – as this will sit at the core of your value. Additionally, unlike many PS firms that tend to be asset light, a valuation will need to take into account all of your physical assets/equipment (if significant).

I have a computer consulting company that I started 17 years ago. IT have about 12 different customers, 3 or 4 of which generate about 80% of my annual revenue. The average annual revenue has been about $85K per year. I have no contracts with these companies. Could I expect to be able to sell it, if so, how much would I expect? I have heard 1 years revenue, and I have seen other companies like it going for 4X, but I’m not sure if they have contacts or not. Thanking you in advance!

Steve. Thanks for your question. Unfortunately, what you describe represents a very difficult business to sell. There is “key man” dependence (i.e. only you!), no formal contracts/commitments and a concentration of 3-4 key customers. It is also unclear how profitable this business is. Ask yourself how much it would cost to hire another you at market rates (including all employer expenses). If the answer is roughly $85k then there is no profit for any purchaser. All these aspects point to low/nil value.

Another line of enquiry for you might be … can I hire someone into my role (train them up, smoothly hand over client relationships etc) and incentivise them to grow a profitable business? That is, provide “market level” salary but bonus them on business growth/development targets (gaining additional clients, adding structures/contracts to business etc). Such an approach might enable you to take a large step back whilst retaining a hold on some future income/profit and the possibility for value-realisation down the line (if you hire well!).

I forgot to mention, that I am the only employee. It’s an S-Corp, and so aside from a few small expenses, all of the revenue goes to me, the owner.

Dom,

Thank you very much for the answer, although that’s terrible news. If I could ask a follow up question, what if I were to get the largest customer under something like a 3 year contract, averaging about 40K per year, or 120K total over three years. Would I have something I could sell then? If so, how much would you say something like that would be worth?

Thanking you in advance,

Steve

Steve

It is not possible to answer that question, without having some more detail re: how much the contract would typically cost to serve (i.e. what is its gross profit?), whether it can be easily novated (i.e. transferred to a new party – without requiring client consent) and, finally/importantly, whether the client company would readily accept another consultant delivering the services (cf. being wedded to you). Dependent on these answers, there could well be some value but this should still be viewed more as selling a novated contract than selling a business per se.

Sorry to be pessimistic in your instance; you should court further opinion also.

I recently took a question by private message on this post. For completeness, the question-and-answer posted back:

Question (from Chad):

Your site seems very informative and valuable. Thank you! My question is on the valuation of a service business. I currently own a real estate sign installation service business (Company A) and a competitor in the same service territory (Company B) is looking to retire after providing this service for over 30 years. My company (A) has been in business for 10 years and we have slowly chipped away at Company B. Since we almost purchased them several years ago, I know their gross revenue has declined from 400K to 100K (present) over the last 8 years. My company has grown continually year over year. I don’t have any real numbers yet, but Company B does about 100K gross revenue and is basically a break even business. Because of the niche type of business, the client base is highly likely to stay on after the sale. The signage is stored at our facility so the will likely use the company that is endorsed by the previous owner and stores the signs. in addition, the current owners health is quickly deteriorating and I can see the quality of the service in the field not as good as well. The business is worth more to me than it would be to any one else because I already have the infrastructure to service everything. What is your opinion on a fair purchase price? They do have some assets, but to be quite frank, I am not interested in any of their current assets. I am mostly interested in the clients.

Response:

Thanks for the question. My thoughts will also come with a hefty caveat that this type of business is some distance away from the professional service businesses I specialise in (consultancy services etc). That said there are some interesting factors here. From a positive perspective:

* You are confident that client base “highly likely to stay on” and “use the company that is endorsed by previous owner” i.e. this is a simple market share purchase.

* You are in a good position to negotiate a good price – declining business, low revenues, owner’s personal circumstances.

The residual questions I have in order to frame a negotiation:

* How much more of market share does this give you? Are you removing key competitor to be virtually monopolistic in your territory or is this just one competitor amongst many?

* How “sticky” are such clients? If it is difficult to win such clients off your competitor in normal course of business then purchase makes sense – else why not attempt to win them over in normal course of your operation (especially so if such clients are becoming increasingly dissatisfied with competitor’s service?).

* How profitable is your business now? How profitable would it become on taking this additional market share?

The last bullet is key and should be the cornerstone of your thoughts/negotiations. Per your question, it sounds like you are just buying clients (market share) with no other material costs transferring or being added. If you can serve this additional base with very little additional direct staffing and overhead – which it sounds like you can – then you can quickly do this math. It is this additional profit delta that is key.

Lets say this acquisition would generate you an extra 80k/annum (80% success re: client retention) – with net profit contribution of, say, 50k (as highly leveraged off your existing operation – minimal extra staffing etc). It is this $50k/annum that is critical – plus the potential to grow it further (e.g. offering additional services to such clients etc). Even assuming it stays broadly static, then you might want to think about value in terms of paying this additional profit contribution TIMES 1-3 years profit sacrifice multiple (i.e. think about it in terms of time to payback). This would give a value of 50k to 150k. The multiple in this regard can be determined by your sense of how difficult it would be to capture these clients yourself, stickiness of clients once “won” (e.g. is average tenure 5y or 20y?) etc.

This assessment would set your upper negotiating limits but clearly you can present a starting position based on their financials – if they have very low profit then you can argue that even a 1*50k type valuation is very generous. Ignoring the example numbers, I hope this makes sense in the type of analytical approach you can adopt to arrive eventually at a “fair purchase price”.

Your advice is based on a business with increasing top and bottom lines. How would your advice change for a business that has been contracting (due to lack of engagement and focus among current owners)? Employees believe they can grow it, but are perplexed at how to value it.

Daniel. Apologies for very delayed response. I have been crazy busy supporting client companies in recent months. The brutal reality is that it is very difficult to value a contracting business – certainly, in such an instance, if there are any interested buyers (rare) they are in a position of strength. From a buyer’s perspective, you would clearly be arguing for very low multiples of EBIT (as it is declining). A broader valuation of inherent value would be predicated on your more intimate understanding of what is possible with the underlying assets/capabilities (service/product line, legacy client relationships, brand, staff good will etc). You might, for example, hypothesise (based on such firm understanding) what profit it is possible to generate in 1-2 years post such an acquisition and, on the premise this can continue to grow, base your offer on that. Ultimately, however, if this is just a single conversation … value will simply be a function of any middle ground between what you are prepared to offer and current owners are prepared to accept. Good luck.

Hi, I have owned a land surveying business for the past 31 years and would now like to sell. I do $480K gross and usually end up with about $180K in profit (after all expenses including my salary of $120K)Any idea how I would put a value on this business. The equipment is worth about $350K

Steven. Apologies for very delayed response. I have been crazy busy supporting client companies in recent months. Is this business just yourself? If so, what you are really selling is your client list (equipment asset transfer can just be dealt with simply/separately). If this is the case, then any potential acquirers’ primary concern will be “how transferable are such clients from you to them?”. Their due diligence would scrutinise the “quality” of this revenue e.g. what is the mix of new clients to returning clients, what is the loyalty/tenure of your average client, do they repeat purchase, how much do they typically contribute per annum? etc. You may well be able to de-risk some of this by offering continued support/assurance to clients for a transition period – to get them comfortable with any new owner. A new owner will also very likely structure the purchase so that actual value is determined post deal as a function of this transference success i.e. you might achieve most of your gain via an “earn out” mechanism.

Another key question will concern legacy growth on these numbers – has your business achieved this type of level statically or is it in steady growth? Also, do you have any proprietary asset/capability that contributes to this success?

Fundamentally, however, you have a profitable business so … if a hard-won client portfolio/network is a key component of this success and you can support any new owner in transferring such loyalty/support over to them … then you can argue for a decent multiple on the resultant EBITDA. Good luck.

Hi there,

I have owned a professional transcription business for the last 10+ years and I am interested in selling it due to a change in profession. It’s a service based business so very low overhead, dedicated team, and very loyal B2B client base. Our growth ranges from 5-30% each year and secures clients solely by word of mouth. We have never advertised, save for a day or two for the first two years of business sending emails to a handful of prospective clients. From there it snowballed. Profit margin is steady at 55% without my involvement in production work (due to being in full-time school). It has been as high as 80% during years I chose to be involved in producing client work. In the last 3 years gross profit has been between $65k and $70k annually, with projections of at least $90k this year. In the last few years we have turned down approximately $10-15k of work because I was in full-time school and could not hire and train people fast enough. No notable assets other than some computer equipment and software.

In the right hands, this business could grow substantially.

I am beginning a new and unrelated profession, however I’m willing to stay on/be available for a transition period of 6-12 months to ensure a very smooth transition for the new owner. I would do all the heavy footwork to ensure that our existing client base and contractors stay loyal to our service.

Any recommendations on how to value a business like this one?

Thank you in advance!

Jamie. Apologies for very delayed response. I have been crazy busy supporting client companies in recent months. To value a business such as this, I would want to first understand what the true underlying net profit (EBITDA) is – factoring into account all costs (including reasonable salaries). Your indication of 80% profit margin suggests to me that this is not taking into account all such factors (especially so if this is net profit!)? The growth % is impressive but in that this is still concerning relatively small absolute numbers, a prospective buyer is unlikely to read too much into this.

Once this (normalised) financial baseline is ascertained, the other key determinant of your value will be a function of all your capabilities that make continued growing profitability highly predictable; for example, nature of loyal/repeating customers, how easy to grow/train team, proprietary software/methods etc. Fundamentally, also, a buyer will want to know what is the potential addressable market here (that you can serve) – are you barely touching the sides or, conversely, is there limited space to grow into? Your ability to help any transition will support this aspect also.

Ultimately, the best way of determining best value is to get a healthy competition underway – with multiple interested parties/bidders. Good luck.

I have established a cleaning company that grosses 56,000 a year. I do all the work myself and run it as a sole proprietorship.

I am getting ready to sell. It includes a van and some equipment to do the work. How should I value the company?

Mike. This type of business is not my speciality but per some of my other replies on this thread, there is only material value in a company if it has generated profit growth (does yours when you deduct reasonable salary/costs?) and has every (highly predictable) chance of continuing this trajectory into the future. If so, even allowing for your complete extraction from the equation, then you can seek to negotiate such value as a function of last 12 months (normalised) profit * a multiple. A typical multiple will be contingent on the sector you are in and all the unique qualities of your business. My sense – but you should check with experts in this sector – is that such multiples will be quite low (e.g. 2-5 * EBITDA) as this type of business has very low barriers to entry, is easily replicable etc. Good luck with it all though.

Hello, I have a professional services civil engineering consulting company that has been operating since 1978. Over the past 15 years, the company has grown to an average of $800k-$1m in revenue, with $600k-$700k costs (not including the owner’s salary). The sole proprietor, while important to the business, believes that an earn out scenario to transfer relationships and ownership to the new owner would be the best for both parties. The new owner would like to scale the business (believes it is possible) and hire someone that would cost ~$120k/year to act as a GM of the business. What would you value this business at?

Hello. The first aspect of a reasonable value determination is to understand the current financial position in detail. You need to factor in a (normalised) owner’s salary to determine what actual net profit levels are. It strikes me that these could be relatively low once factored in. I would also want to know what type of gross margin is being achieved before overheads factored in. Finally, it is difficult to tell from this how the business has actually traded to this point: consistent growth or meandering up/down path? All of these aspects determine the “quality” of the revenue/profit.

Thereafter any multiple of this figure will be predicated on a number of factors: clarity of service proposition, quality of client loyalty and fee pipeline, staff quality/retention, established sales system, intellectual property, reputation/awards etc. In your sector, this multiple can range from 3* to 10* dependent on all such qualitative/systemic factors (set against a genuinely normalised EBITDA). Hopefully helpful.

Hi Dom

I have an accounting software consulting / bookkeeping business. I have been running this for the last 6 years and have built up a very good client base over this time. I am interested in selling the business to a person who had good knowledge of my business as she has worked for me occasionally over the last 2 years and is keen to buy, for the right price. I am not sure how to value this however.

The business is unique in that it is the only one selling and supporting this accounting product in a small country of approx 12000 people. The majority of business here use this software and this does not look to change in the near future as the market here is not very well placed to be able to take advantage of new online accounting solutions and so competition from outsiders is not a great concern at this time. Also as the business has a good reputation here as being the ‘one stop shop’ for our services which I also don’t see as changing if I sold to the intended buyer.

Turnover was steady for the first 5 years at approx 50-55K per annum with adjusted EBITDA profit of 30 – 35k. Last year this changed considerably as I took on premises (previously home based business) which has good street frontage and turnover doubled & adj Profit increased to 44k.

My drawings sit at approx 31k per year. The chargeable hours for the turnover as mentioned above are approx 20 hrs per week part time.

I have always run the business solely but there is lots of potential for growth specifically in the bookkeeping area which presently contributes approx 18% of revenue. The buyer would be looking to run the business herself as I have been doing initially. I have read some of your comments for other business and they are very helpful. I wonder if you have any advise that could help me with putting a value to my business, Regards Helen

Helen

Firstly, many apologies for such a delayed revert. I have been extremely busy with multiple projects and your comment slipped through my net. If still relevant (i.e. you have not already sold) then I would say …

Such singleton businesses are inherently difficult to value … it often comes down to “What the buyer is prepared to pay”. They are difficult for many reasons: the (sole) owner is intrinsically “the business” … and the buyer has to ascertain to what degree this can be separated from onward client relationships/sales etc. Also, it can be difficult to get to a true sense of profit – the buyer needs to normalise profit by market-level salary/drawers etc (the maths didn’t fully flow in this regard). As such, I would encourage you to create a competition if possible. Evidence suggests that vendors discount business value by c. 15% on average when they talk to a single prospective party … “one buyer is no buyer” and all that.

The other self-identified challenges you have is primarily static performance (albeit last year’s revenue jump clearly very encouraging) and the nature of the business (and threat from online alternatives). What are the characteristics of the country that neuter the online threat of alternatives? Such assessment would certainly feature heavily on the buyers’ mind. With respect to the revenue/profit growth, most buyers would really want to see a couple more years of this trajectory (else they will not know if a growth trend or a one-year blip).

As a side thought, what about employing the known individual with contingent bonus (maybe growth shares) and holding onto the profit distribution and equity value? If you seek to “cash out” because you fear the macro trend (re: online threat etc) then you have essentially answered your own question re: value.

Sorry again for delay; if still relevant, I wish you every success.

Regards

Dom

hello,

I have a 6 year old IT consulting business with 80 employees with $9M annual revenue. I have been offered $2.4M. Profits as per my tax filings are 250K but really are around 700-800K. Should I sell ? I mean is it a good price ?

Regards

Sam

Sam

Firstly, many apologies for such a delayed revert. I have been extremely busy with multiple projects and your comment slipped through my net. If still relevant (i.e. you have not already sold) then I would say …

At face value (and blind to a plethora of other detail required) this appears very low. Taking also at face value the “normalised” profitability of $800k from last year (presumably grown year-on-year) then this is c. 9% profit. This is not stellar (one would hope to see 15-20% plus in this sector) but profit nonetheless. If you have been growing consistently and making reasonable investment in the capability-development of such a company (marketing/selling/staff training/IP etc.) then you would expect to see at least 5* EBITDA. Recent 2016 data would suggest an average EBITDA multiple of 8* for such businesses (Source: http://www.equiteq.com/) – albeit these surveys use public “un-normalised” P&L data which deserve some caution – you can typically discount back c. 30% again (i.e. to suggest average of 5.6 * “normalised” EBITDA). Taking all of this together (with a huge chunk of assumption in respect to the myriad of other considerations behind such valuations) and one expect to see a valuation in the $4m range at least.

My summary point – that I make often – is to be extremely wary of the solo solicitation. Evidence suggests that vendors discount business value by c. 15% on average when they talk to a single prospective party … “one buyer is no buyer” and all that. I really encourage you to do this in a way that is proactively managed by you – to your timescale – in order to derive a formal, managed competitive result. More work required your side but you will never regret this with respect to enhanced value created.

Once again, apologies for delayed response. If still a live issue, I wish you every success. Also to say a huge well done in generating such a scaled profitable business in such quick order – hugely impressive.

Regards

Dom

Hi, first thank you for such a great website and information!

I am looking to buy an IT services company that provides tech support to SMEs, monitoring their servers, helping with purchases, implementation and eg moving to the cloud etc.

I’m looking at businesses with adjusted EBITDA of about £200-400k. Some have more customer concentration, some are only 3 years old and some project higher growth so there are lots of qualitative factors as you say.

Could I ask what the rule of thumb multiple is for such businesses?

Thanks for the great website again!

Robert

Firstly, many apologies for such a delayed revert. I have been extremely busy with multiple projects and your comment slipped through my net. If still relevant then I would say …

Recent 2016 trading data would suggest an average EBITDA multiple of 8* for such businesses (Source: http://www.equiteq.com/) – albeit remember these surveys use public “un-normalised” P&L data which deserve some caution – you can typically discount back c. 30% again (i.e. to suggest an average of 5.6 * “normalised” EBITDA). In reality, however, per your comments this multiple range can vary greatly (say, 3-12 *) contingent on all the qualitative factors you reference. For a description of such qualitative considerations see additional blog posts on my site and my “Fundamental Components of Value” guide.

Good luck with the purchase and onward value creation!

How do you value a business when partners are looking to split and the first three years have been all about investment with no profits? The partners work specific jobs but do not get paid rather, every penny taken in, go right back into expansion, fixtures and equipment.

Chris

The brutally honest answer is that, unless you have valuable assets, there is often very limited value in such businesses – especially so if the business is not yet generating market-level salary remuneration either. It sounds like more a case of dividing up the established net assets commensurate with any pre-agreed partnership agreement (and/or relative contribution to the venture)?

Sorry I can’t be of more help in this instance.

From Bill L:

Hi,

I’m looking for some help in finding an industry standard metric on purchasing a computer consulting firm in the NY\NJ metro area. The company currently is flat in terms of cash flow but in the right hands can turn a profit. Current sales come in around $287,000. Due to current circumstances, the options I’ve seen so far to use (cash flow, earnings) don’t easily apply.

Thanks,

Bill

The latest M&A figures (see for example, Equiteq’s annual M&A report – http://www.equiteq.com) would suggest that the average revenue multiple for IT consulting firms is around 0.8x (for latest available data at least). The revenue multiple can be used as a very crude proxy – BUT – please remember this is just an industry average (nothing more). I like this cautionary tale of averages: you should always be wary of crossing a river that is, on average 4′ deep – this could just mean that it is 1′ deep in one section and 7′ deep in another! A similar caution is warranted here. Ultimate value will really hinge on whether profitability is possible quickly as a function of some inefficiency you can quickly reverse – and – whether fundamental capabilities are in place e.g. clear service propositions, loyal clients, sales capability etc. If the conversation is just between you and the vendor then you are clearly well placed to negotiate. Good luck finding what you seek.

Hi Dom,

I have an IT sevices/consulting business with a small team of 10 people, I have 2 big clients both on annual contracts as well as small clients with small projects on and off. My annual revenue from 2 big clients is about $200k (plus revenue from smaller projects which is not certain) with EBITDA of $120K.

I want to sell my business, how much valuation do you think I should go with, is there any thumb-rule for this? and do you think anyone would be interested in buying my firm?

Thanks looking forward to your reply.

Hi. Latest trading results (see Equiteq.com’s excellent reporting) woudl suggest that IT service companies are trading very well currently (1.1 * Revenue, 11.0 * EBITDA; as at end Q2 2017). Please note, however, such figures based on publicly reported data should be discounted by at least 30% – so lets say (0.8 * revenue; 8 * EBITDA). Again these are just averages and it all hinges on whether (a) you are actually saleable and (b) if so, what are the inherent capabilities of your business that de-risk future profitable cash flows. The reliance on two major clients will seriously damage this (maybe defer selling to build diversity here?). Also, not sure how you can be deriving an EBITDA of $120k with staff of ten and revenues of c. £200k? Unless very part-time staff?

Hi Dom,

Thanks for being awesome and giving this knowledge!!.

However, I didn’t quite get what you meant by “(a) you are actually saleable”.

With regards to this:

“(b) if so, what are the inherent capabilities of your business that de-risk future profitable cash flows”

Sure right now there is a huge risk, if either of the client pulls the plug. Working on addressing that and situation should improve considerably within the next 6 months.

Cheers!

Hello Dom,

We own a realestate and investment providing company that been operating for around 7 years now. Now we have someone wants to come on board. how can we evaluate the company since we have no assets more than our client base which is a combination from local and international investors along with access to wealth management.

Hi.

I would need a lot more information to give a view on this. Not sure if you are offering professional services or more financial advice. If the latter – I am not well placed to comment. If the former, you might want to take a look at my guide on “The Fundamental Components of Value”. Read that and you will have a good sense of your own firm’s value.

Hi! I have a company that is 5 years old and does very specialized software consulting, integration, and license sales. We have 11 engineering billable headcount and 3 non billable senior staff including myself. Our consulting income in 2016 was $2.5m and license sales were $1.2m with $950k of that being pass through dollars. We are on track this year to do $2.8m in consulting, and $1.9m in license sales with $1.55m being pass through. We are carry8ing $300k in long term debt. We are actively being looked at by several parties for acquisition or merger, and I am of course going to start retaining legal and consulting help on this, my first rodeo. I am curious what your thoughts are on valuation. We don’t have a ton in the way of assets, maybe $200k in IP for some custom software development which has yet to see light of day, and another 200k in computing resources.

Hi. This is a far from straightforward question as you are essentially a PS and software (reseller) business. Taking the PS component first, it will hinge on your EBITDA levels and whether these have grown over previous years? I advise others to show at least three years of 20%+ growth in this aspect – as required to attract buyer interest. Thereafter, you will achieve good multiples (IT sector averaging about 8 * EBITDA recently) if your business is well constructed (as per my guide). With respect to software sales – this is not my area of expertise and can operate to very different dynamics. Clearly, valuations here are all predicated on forward pipeline predictability – but I understand recent software-based companies are trading at an average of c. 5.4 * annual revenues. For yourself, this would relate to your resell commission (assuming such contractual arrangements are protected and can be novated to others?). The assets you mention wouldn’t typically impact on this form of valuation – albeit the debt would be taken into consideration (essentially netted off any settlement if it transfers to buyer). Great news that you are doing this with retained expertise and courting a proper competition. I wish you all the very best with your first rodeo!

Hi!

I have a business that I started in 2008 that I am thinking about selling but I’m not really sure if it would be worth it. It is a pet boarding and grooming facility. One of my issues is the boarding side doesn’t require much skill, but the grooming side requires a lot of skill. I currently have three groomers ( I am one of them). I only groom three days a week. I then have one full time groomer and one groomer 4 days a week. The full time groomer is moving away in a month so she wouldn’t be included in the business. I would be more than happy to help someone train a few groomers but then after that I would like to have no involvement with the business. In 2008 the business made 12,000 and this year we are on track to make 300,000 (gross). I currently draw a salary of 55,000. There is also $430,000 in real estate value (which I would like to include in the sell) and I have approximately $320,000 in debt. I want to sell the business because I’m extremely burnt out on all of it and I’m about to have my third child. Would it make since for me to sell it or should I just keep chugging along hating my life for a while longer?

I am considering buying a swim club that has a swim lesson program with it. for additional revenue.

How would I calculate the fair value sale price?

Thanks much

Hello Dom,

First of all information you provided to questions is very detail and helpful.

I am considering to buy an offshore software consulting company that provides software development and maintenance to companies based in US and UK. They currently have revenue of $1.3M, in 2013 they had revenue of $3M but they lost around $500k in 2014 because one of their client filed bankruptcy. Current owner is planning to retire and is not focusing on company growth. Last 3 years they had consistent revenue of $1.3m, have debts around $500k. Current owner is ok to sell 51% equity and continue to work for next 3 years.

Two questions

a) Is it ok to valuate the company 7 times of EBIDTA and

b) to buy his rest of 49% , do I have to consider the EBIDTA including the revenue I bring in, or just the revenue he brings in?

My wife and I started a private home health care business (non-medical). Year one we grossed 137,000, year 2 was $510,000, and year 3 was 820,000. What would an estimated valuation of our business be? After taxes, expenses, employee pay, our net profit is between 17 and 19%. Just looking for a ball park figure, I have no idea.

With all my usual caveats re: the devil really being in the detail – and please note that home health care is not my sector (my blogs talk to the professional services B2B community) – then this answer seeks to give you a very rough “ball park”. Assuming also that your profit figure is true “normalised” profit (e.g. net of owners’ normalised salary etc.) then you are looking at c. $150k * multiple. I have no idea what multiples are doing in your sector currently – but the very rough comparable with PS companies would range between 5-10 dependent on capabilities/qualities of the business i.e. the ease by which a new acquirer could pick up your book and continue with (predictable) future profit growth. Hopefully helpful as a very rough guide.

I have a specialist multi disciplinary engineering consultancy practice of 30 person with annual fees of $4m and EBIT of 30%. Year on year growth of EBIT is 30%+ for last 3 years.

There’s good synergy with a buyer who is a multi national consultancy firm due to our very niche position in our field and geographic location.

I would appreciate if you can share the potential valuation?

Thank you.

Andrew. Apologies for very slow revert – busy with a number of projects currently. Suffice to say, your summary figures (EBIT > 20% AND EBIT YoY growth > 20% for three years) are excellent and place you in a very strong position. Thereafter, per my blog and various comments, the “devil will really be in the detail” with respect to all of the capabilities within the business that, in turn, provide reliable prediction to the fact this growth can continue (cf. it being based on temporary/fortunate conditions e.g. one gifted salesman, small client base etc.).

On the basis this all sound, engineering companies are still transacting for c. 6-10 * EBITDA (see equiteq.com for great source for latest M&A data). Please note that the multiples shown for unadjusted (public stated) MULTIPLE*EBIT calculations will always be higher than the real-world multiple value (because such EBITs are invariably understated). My 6-10 x is a realistic band prediction so you can do the math from there.

Finally, I would say that if there are unique synergies with an interested buyer all this conventional logic can become somewhat marginal. Fundamentally, if you are the last piece in a jigsaw for them to unlock value in their growth journey then you can negotiate this value up further. I would always encourage you to add some competitive tension into this conversation though – so be very wary of the “one buyer” conversation without this alternative option review.

Hopefully some great advisors on your shoulder will step you through all this.

Wishing you every success – sounds like you have built a great business there!

Dom some advice please

I run with a partner a consulting business i am wanting to retire and want to sell my stake or alternatively draw on dividends in retirement. Advice please on valuation.

EBIT 2018 is $250k with outstanding loan and tax liability circa $70k growth 65`% on previous year