Typical Multiple Values of Professional Service Firms

Welcome to the latest blog focused on the topic of building a successful consulting business. In a previous blog, I explored the concept of a multiple in the context of the classic firm valuation formula (EBITDA * Multiple). In this short article, I look at some typical multiple values. It is an extract from Guide 02 (Fundamental Components of Value) of the ‘Five-Year Entrepreneur Series’. This Guide takes a detailed look at profitability (a function of margin, productivity and leverage) and covers a wealth of checklists and ‘Top Tips’ for growing profit in your business. Put another way, Guide 02 dwells on the topic of value – specifically as it refers to the financial price a buyer would be willing to lay out for your company in the future. Helping you to understand this is an extremely important step in the context of a series that seeks to navigate its readers to a stage when such value has a real, potentially life-impacting, quality.

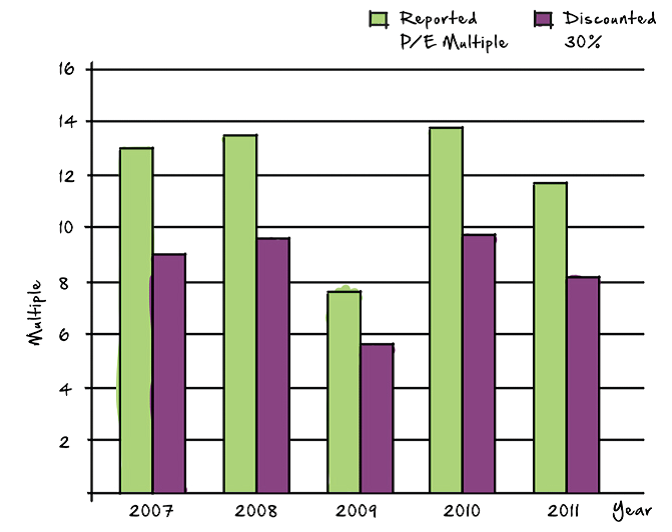

Now that we have covered the topic of EBITDA (Earnings) multiples, you probably want to get a feel for the ranges they typically fall within. The graph below shows some historical data for professional service firms sold in North America from 2007 to 2011:

As I mentioned in a previous blog, as private companies are generally owner-managed, reported profits tend to be restrained by various expenses that may be non-recurring under a new owner. This will have been factored into the price the purchaser paid, but may not be reflected in the profits declared to the public. The effect of this is that the multiple paid – as calculated from the publicly available information – is invariably overstated. I recommend, therefore, that you pay more attention to the second data series in the graph (that I have discounted back by 30% – a sound working assumption as to the difference) for a more realistic sense of the multiple range you can achieve.

In the next article, I will look at the questions of ‘when are you saleable?’ and ‘who is buying?’.

——————

What are/is the current ebitda mutiple for a CPA Firm

Bryan

Equiteq undertake an annual report on M&A activity and there 2016 Report (source: http://www.equiteq.com) analysed the “Financial Advisory” sector as having a six-year median multiple value of 7.5x (Low 5.2* and High 10.7*). This figure was 6.6* for 2013-2015 period. Please remember these surveys use public “un-normalised” P&L data which deserve some caution – you can typically discount back c. 30% again (i.e. to suggest a median of 5.2 * “normalised” EBITDA).

Please remember these are just averages – actual values are wholly contingent on the unique, idiosyncratic features of the specific company.

Hopefully helpful.