Profitability explained … to owners of professional service firms

Profitability Explained

Photo Credit: Dave Dugdale via Compfight cc

Profitability Explained

It should be clear to you from my previous blog posts, if indeed it needed reinforcement, that profitability (and profit growth thereafter) needs to become your fixation if you are ever to build a company with value.

As the old maxim goes:

Revenue is Vanity, Profit is Sanity, Cash is Reality.

In order, therefore, to protect your sanity – and your future wealth potential – we dwell now on how profit is derived – and measured – in a typical professional services firm. As an aside, the cash management point is also rightly emphasised in this maxim – and I will look at this in detail in a future Guide (Guide 15).

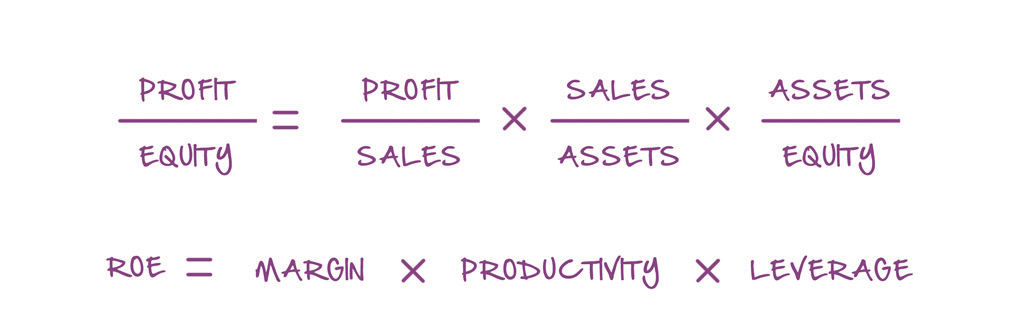

Let’s look first at the classic DuPont Formula1 as it is used to calculate Return on Equity (ROE) in a typical, industrial company:

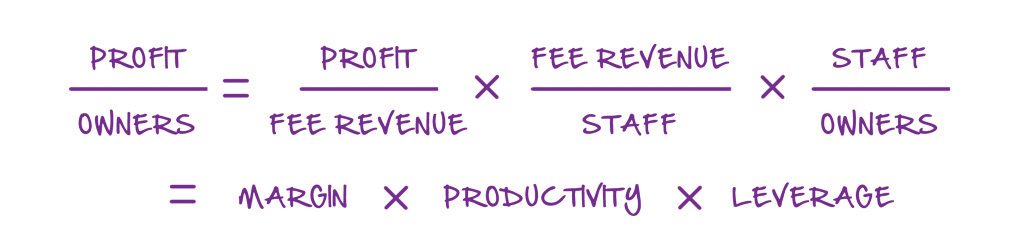

In the case of a professional services firm, equity is typically in the hands of the managing owner(s) (‘partners’ or ‘directors’ are common terms used to distinguish them from the non-equity-owning, salaried staff). As such, ‘Profit per Owner’ is the equivalent of ROE in this context. The total assets employed are effectively a combination of the ownership equity investment (time and effort of the owners) and the non-equity-owning staff. Financially, the salaries of this latter group are comparable to fixed-interest, debt-financing assets in a conventional business.

So, for a professional services firm, the fixation is with:

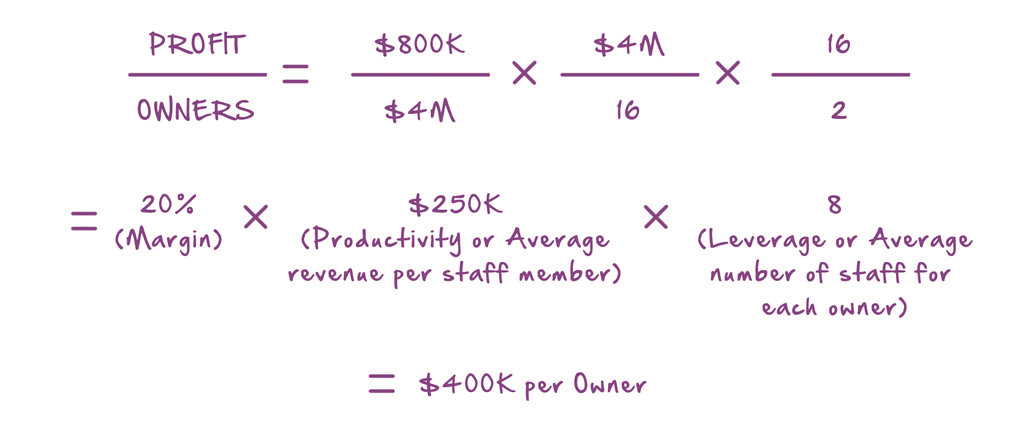

To illustrate, for a small company with two equity-bearing owners, making a profit of $800k on $4m revenue with sixteen fee-earning staff:

A future Guide (Guide 05) will cover the central discipline of capturing, and analysing, regular management information (MI) in your business in order that effective actions and decisions are being made with tempo. You will not be surprised now to know that this ‘Profit per Owner’ formula rendition needs to sit at the heart of this reporting format – with sub-levels that ‘mine’ down into each of the three critical aspects – margin, productivity and leverage.

It is also worth saying now that in managing profitability, you must focus on each of these elements – it is a mistake to omit any one of them from your continuous analysis. For example, if your reporting system focuses on productivity at the exclusion of leverage, you may erroneously reward an owner who is driving high personal utilisation and fee rates – as compared to a fellow owner, with low productivity, who is highly leveraged. Yet, the latter (who is managing more junior staff colleagues effectively) is likely to be putting more profit into the business.

With experience, and a certain degree of experimentation, you need to get to the optimal profitability blend – recognising en route that you always have these three ‘levers’ to pull.

——————