Optimising your Profit

So, improving profitability is about managing your margin, productivity and leverage in an optimal, balanced way. But, what does this mean in practice?

Let’s take each in turn.

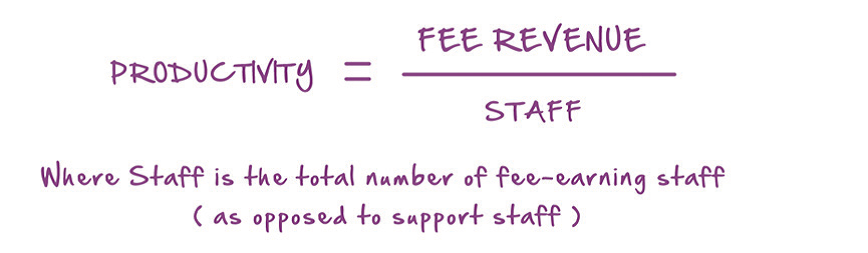

Firstly, margin. The truth is that margin, in a business that sells people’s time, is primarily about productivity and leverage (as the main cost will be salaries – directly related to the number of staff in the business). If you are achieving high productivity (i.e. high fee volume per staff member) and high leverage (i.e. high numbers of non-equity-bearing, fee-earning staff to each equity-bearing owner), then margins will tend to be very good. The only reason why they will not be is if other, secondary costs in the business (e.g. office, support staff, IT equipment etc) are being poorly managed. That said, whilst such costs need to be carefully managed out of good business ‘hygiene’, avoid the temptation to continually prune them for short-term profit growth; as it is on such support foundations that long-term growth will be based. So, in summary, there is a place for margin management but it is more a tactical aside in relation to the strategic, long-term impact you can make by focusing your attention on productivity and leverage. So, what do we really mean by productivity? Starting with the term in our formula:

Put another way, it is the average revenue earned per fee-earning staff member.

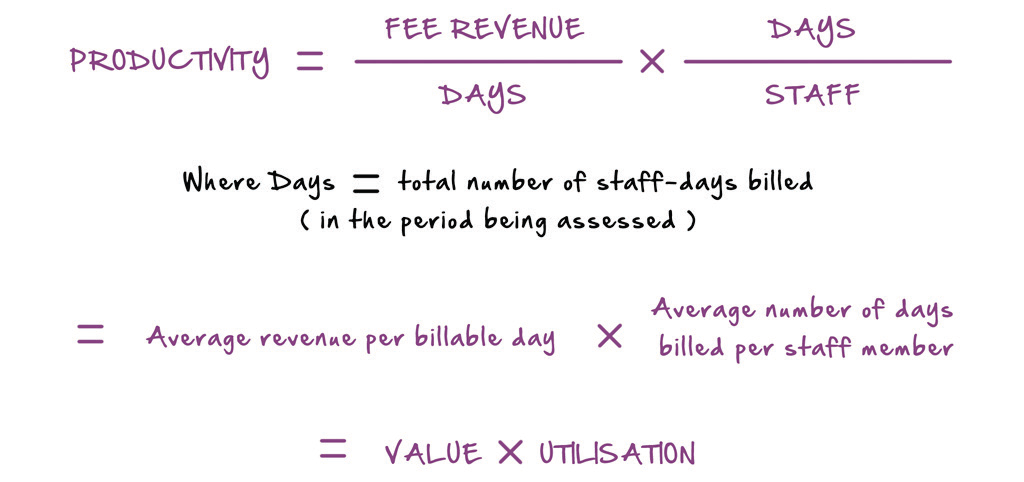

Breaking this down further:

Taking each part of the productivity formula there is, again, a need to separate out tactical (short-term) improvement approaches from strategic (long-term, sustainable) ones. In the former category, sits all efforts to increase utilisation. This has its place and you are right to be fixated about achieving a certain target level but be very wary about an overbearing focus once this is achieved. A strategy that seeks to improve utilisation year-on-year is doomed to fail – as once you pass optimal ‘healthy’ levels, a greater volume of billed days/hours per staff equates to disenfranchised people, poor morale, low levels of innovation and, inevitably, an irresponsive business development capability. All of which spells disaster for longer term value creation.

Rather, the savvy approach is to focus on ‘value’ or the rates you are able to charge. This is, clearly, more than just a case of raising your rate card. In order that your clients can accept this, you need to develop the underlying fundamentals that they value; for example, providing them with first-rate skilled staff, relevant technical specialisation, thought leadership and supporting resources/tools/software etc. Moving up the ‘value chain’ in this regard is central to growing your firm’s profitability in a sustainable way.

Finally, leverage. This, like the value derived from your average fee rates, is a strategic issue for your business. Once you have managed overhead costs and utilisation to healthy levels, it is only by improving your fee structure – or your leverage – that the economics of your business will improve commensurately. This is such a fundamental area, that Guide 03 on Business Planning covers it in some detail. Suffice to say for now that leverage is the ratio of your equity-bearing owners (maybe just you for now?) to the non-equity-bearing, fee-earning staff. As a further detail, leverage concerns itself with the shape of the grade structure – typically pyramidical – beneath the owner(s). A high-leveraged business has many staff members to each owner, whereas a low-leveraged business has a small number of staff to each owner.

So what is the right leverage for your business? The answer to that is the highest leverage you can achieve without compromising the value you offer to your clients for the type of work you do. So, if your work tends to be procedural, you are able to be higher-leveraged than a business that engages in more specialist, expert tasks. The former type of firm can perhaps add intelligent, relatively inexperienced juniors to the engagement team whereas, in the latter case, maybe only a small number of very experienced staff can fulfil the client’s requirement. In short, leverage is about getting the right balance between delegation (ensuring that work is always done by the most junior resource capable of doing it) and skills matching (ensuring that this meets the skill requirement your client’s problem demands).

To be continued …

——————